In today’s world, credit plays a pivotal role in financial stability and opportunity. A healthy credit score opens doors to favorable interest rates, better insurance premiums, and increased access to loans and credit cards. However, many individuals and businesses face the challenge of damaged credit, which hinders their financial growth. This is where Credit Repair Cloud comes into play, revolutionizing the credit repair industry with its comprehensive software platform.

This article aims to provide a detailed guide on Credit Repair Cloud, covering its features, benefits, and how it can transform your credit repair business. Whether you’re a seasoned credit repair professional or someone aspiring to enter this rewarding industry, read on to discover the power of Credit Repair Cloud.

Understanding Credit Repair

Before diving into Credit Repair Cloud, it’s crucial to grasp the fundamentals of credit repair. Credit repair is the process of improving an individual’s creditworthiness by addressing errors, inaccuracies, and negative information on their credit reports. It involves analyzing credit reports, disputing erroneous entries, negotiating with creditors, and monitoring progress. Credit Repair Cloud simplifies and streamlines these complex tasks, empowering credit repair professionals to efficiently serve their clients.

Introducing Credit Repair Cloud

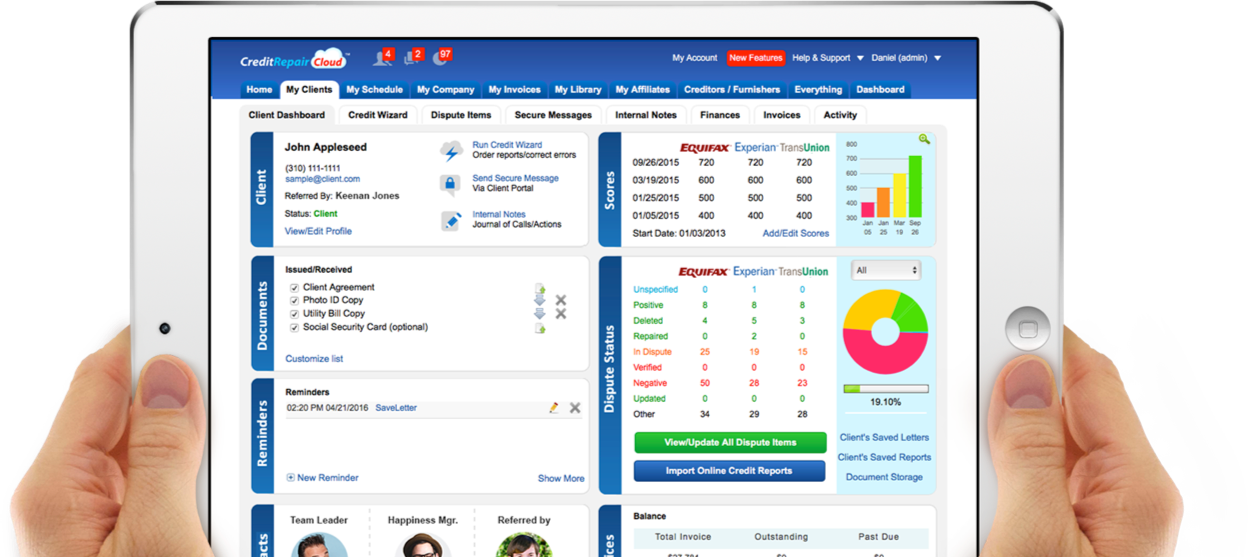

Credit Repair Cloud is a leading cloud-based software platform specifically designed for credit repair businesses. Founded in 2002 by Daniel Rosen, it has grown to become the industry’s most trusted and comprehensive solution, serving thousands of credit repair professionals worldwide. The platform offers a suite of tools and features that enable businesses to automate and scale their operations, saving time and maximizing efficiency.

Key Features of Credit Repair Cloud

Credit Repair Cloud is renowned for its extensive range of features that cater to every aspect of the credit repair process. Some of its key features include:

a. Client Management: Credit Repair Cloud provides a centralized hub to manage clients’ information, credit reports, and progress tracking. It enables professionals to efficiently organize and streamline their workflow.

b. Dispute Management: The software simplifies the process of identifying inaccuracies, generating dispute letters, and tracking the progress of each dispute. It automates the generation of personalized dispute letters, saving significant time and effort.

c. Credit Report Analysis: Credit Repair Cloud offers comprehensive credit report analysis tools that highlight negative entries, inaccuracies, and areas for improvement. These insights empower professionals to develop targeted strategies for their clients.

d. Automation and Workflows: The platform allows users to automate various tasks, such as sending dispute letters, reminders, and follow-ups. This automation enhances productivity and ensures a consistent approach to credit repair.

e. Integration and Collaboration: Credit Repair Cloud seamlessly integrates with various third-party applications, including credit bureaus, merchant processors, and lead providers. It facilitates efficient data exchange and collaboration, enhancing the overall workflow.

f. Marketing and Lead Generation: The platform includes built-in marketing tools to attract and convert leads. It offers customizable websites, landing pages, and lead capture forms, enabling businesses to establish a strong online presence.

Benefits of Credit Repair Cloud

Credit Repair Cloud offers numerous benefits that empower credit repair professionals to transform their businesses and deliver exceptional results to their clients. Some key benefits include:

a. Efficiency and Time Savings: Credit Repair Cloud automates manual tasks, streamlining the credit repair process. Professionals can save time by generating dispute letters, tracking progress, and managing client information within a centralized platform. This efficiency allows businesses to handle a larger volume of clients and increase productivity.

b. Enhanced Client Management: The software provides a comprehensive client management system, allowing professionals to track client progress, communication, and billing details in one place. This organized approach enables better client service and fosters stronger relationships.

c. Compliance and Security: Credit Repair Cloud adheres to industry regulations and implements robust security measures to protect sensitive client data. Professionals can have peace of mind knowing that their clients’ information is secure and their business is compliant with legal requirements.

d. Customization and Branding: The platform offers customizable websites, landing pages, and email templates, allowing businesses to showcase their brand and create a professional image. Customization options help in attracting and retaining clients, giving businesses a competitive edge.

e. Data Analysis and Reporting: Credit Repair Cloud provides detailed analytics and reporting features to monitor business performance and track client progress. Professionals can analyze trends, identify areas for improvement, and make data-driven decisions to optimize their operations.

f. Scalability and Growth: With Credit Repair Cloud, businesses can scale their operations efficiently. The software handles large client volumes, automates repetitive tasks, and enables seamless collaboration with team members. This scalability allows businesses to expand their reach and grow their client base.

How Credit Repair Cloud Transforms Your Business

Credit Repair Cloud’s transformative impact on credit repair businesses is profound. Here are some ways the platform can revolutionize your business:

a. Streamlined Operations: Credit Repair Cloud simplifies and automates complex credit repair processes, enabling professionals to focus on strategic tasks. By eliminating manual efforts and centralizing client information, businesses can achieve operational efficiency and deliver faster results.

b. Improved Client Experience: The platform’s user-friendly interface and automated workflows enhance the client experience. Clients receive regular updates, personalized dispute letters, and access to progress reports, fostering transparency and trust. A positive client experience leads to higher satisfaction rates and increased referrals.

c. Enhanced Productivity: Credit Repair Cloud’s automation features enable professionals to handle a larger volume of clients without compromising quality. Tasks like dispute letter generation, follow-ups, and reminders can be automated, freeing up time for proactive client engagement and business growth.

d. Business Insights and Analytics: The software provides in-depth analytics and reporting, allowing professionals to gain valuable insights into their business performance. Key metrics such as client acquisition costs, conversion rates, and dispute success rates help in making informed business decisions and identifying areas for improvement.

e. Collaboration and Team Management: Credit Repair Cloud enables seamless collaboration among team members. With role-based access controls, professionals can assign tasks, track progress, and communicate effectively within the platform. This collaborative environment promotes teamwork and boosts overall productivity.

f. Marketing and Lead Generation: Credit Repair Cloud’s built-in marketing tools and customizable websites assist businesses in attracting and converting leads. Professionals can create engaging content, capture leads through customizable forms, and nurture them through targeted email campaigns. Effective marketing strategies contribute to a steady flow of clients and business growth.

g. Scalability and Expansion: The scalability of Credit Repair Cloud empowers businesses to grow and expand their operations. The platform can handle an increasing number of clients, automate processes, and integrate with other tools to support business growth. Whether it’s expanding the client base or adding new services, the software provides a solid foundation for scaling the business.

Credit Repair Cloud is a game-changer in the credit repair industry, offering unparalleled features and benefits that can transform your credit repair business. From streamlining operations and enhancing client management to improving productivity and driving business growth, Credit Repair Cloud empowers professionals to deliver exceptional results.

By leveraging the platform’s automation capabilities, professionals can save time, handle larger client volumes, and focus on strategic tasks. The centralized client management system enables efficient organization, better communication, and enhanced client service. With customizable branding and marketing tools, businesses can establish a strong online presence and attract a steady stream of leads.

Credit Repair Cloud’s data analysis and reporting features provide valuable insights into business performance, allowing professionals to make informed decisions and optimize their operations. The platform’s compliance and security measures ensure the protection of sensitive client data, instilling trust and confidence.

Furthermore, Credit Repair Cloud fosters collaboration and teamwork through its seamless integration and team management features. As businesses scale, the platform provides the necessary infrastructure to support growth and expansion.

In conclusion, Credit Repair Cloud offers a comprehensive and powerful solution for credit repair professionals. By harnessing its features and benefits, businesses can unlock the full potential of their operations, drive client success, and achieve remarkable growth in the credit repair industry. Embrace the power of Credit Repair Cloud and revolutionize your credit repair business today.

You have to wait 30 seconds.