Investing in bitcoin can seem complicated. However, a few minutes are enough to buy it, even for a beginner who has never heard of cryptocurrencies. Investing or trading bitcoins only requires creating an account on a cryptocurrency exchange platform and then carrying out a transaction against euros. However, investing savings in cryptocurrencies is riskier than traditional investment vehicles. In this guide, we give you the essential keys to understanding before investing in Bitcoin.

Some Basics to Understand Bitcoin

History and operation of Bitcoin

When the American bank Lehman Brothers suddenly went bankrupt in 2008, the world plunged into a violent economic crisis. In response to this situation, phenomenal amounts of money are printed, which causes a loss of value and record inflation.

Known under the pseudonym of Satoshi Nakamoto, an individual sets out to offer an entirely online peer-to-peer money transfer system. The primary objective of cryptocurrency is then to free money from the control of the “culprits” of the financial crisis, by offering a stable and transparent system. The goal is as follows: two people, anywhere in the world and regardless of their situation, can exchange bitcoins without involving a bank, a public body or an institution. All they need is an internet connection.

Thought as a limited quantity store of value, Bitcoin puts forward a vision: that of a global electronic money, freed from the control of central banks. Bitcoin becomes an innovative payment network and a new form of money:

- the management of transactions and the creation of new units of bitcoins is managed collectively by the network of users;

- Bitcoin is free and open. Its design (its computer code) is public;

- no one owns control of Bitcoin, and anyone can join;

- Thanks to unique properties, Bitcoin makes possible promising uses that could not be covered by existing payment systems until now.

A transaction made with Bitcoin cannot be stopped, since it is a computer network that manages the entire transaction. There is no customer service, like in a traditional bank where a banker can modify a transfer of funds.

Blockchain is the Technological Support of Bitcoin

Each transaction involving bitcoins is recorded for life on the blockchain. It can be compared to the register of a bank or to an account book which lists the inflows and outflows of funds. This blockchain is public, and distributed across the entire network. It is decentralized. You can’t “shut it down” or take control of it unless you have 51% of the grid’s energy capacity. Which is unthinkable at the present time.

The quantity of bitcoins is limited to 21 million. It is of course not mandatory to buy a whole bitcoin, since it is a unit divisible into fractions. For example, you can exchange 0.000001 BTC for a few tens of euros.

Specialized computers allow mining bitcoin, a crucial operation for securing the network. To simplify, these computers perform very complex equations to verify, confirm and record transactions. To incentivize miners to participate in the work of securing the blockchain, the Bitcoin network rewards machines that find the requested mathematical solutions first.

The Pros (and Cons) of Investing in Bitcoin

Bitcoin’s impressive performance has attracted many traditional and institutional investors. Several notable advantages have allowed it to reach such a value today:

- it is a liquid asset: it can be exchanged quickly and at any time against another cryptocurrency or against a state currency;

- Bitcoin can serve as an alternative currency to fight inflation. Its limited quantity makes it a stable store of value that can help some populations protect their savings;

- its value may continue to increase due to its rarity. Which is a good thing if you’re going to invest in Bitcoin for long-term capital appreciation.

While it may be the future of forex trading, it is equally important that you are aware of the risks surrounding cryptocurrency investments. Below are a few things to be aware of that work against Bitcoin. As a wise investor, you will be able to weigh the pros and cons, in order to decide whether you want to acquire bitcoin in your assets:

- its value is volatile: the price of BTC can vary by 15% in one day, both up and down. So be aware that the variations are important, and that you have to be able to bear them without panicking;

- a technological risk exists. Even though the Bitcoin blockchain has never been hacked, many BTC holders have had it stolen due to lack of precaution, not securing their private access keys enough, or trusting a hacker.

How to invest in Bitcoin?

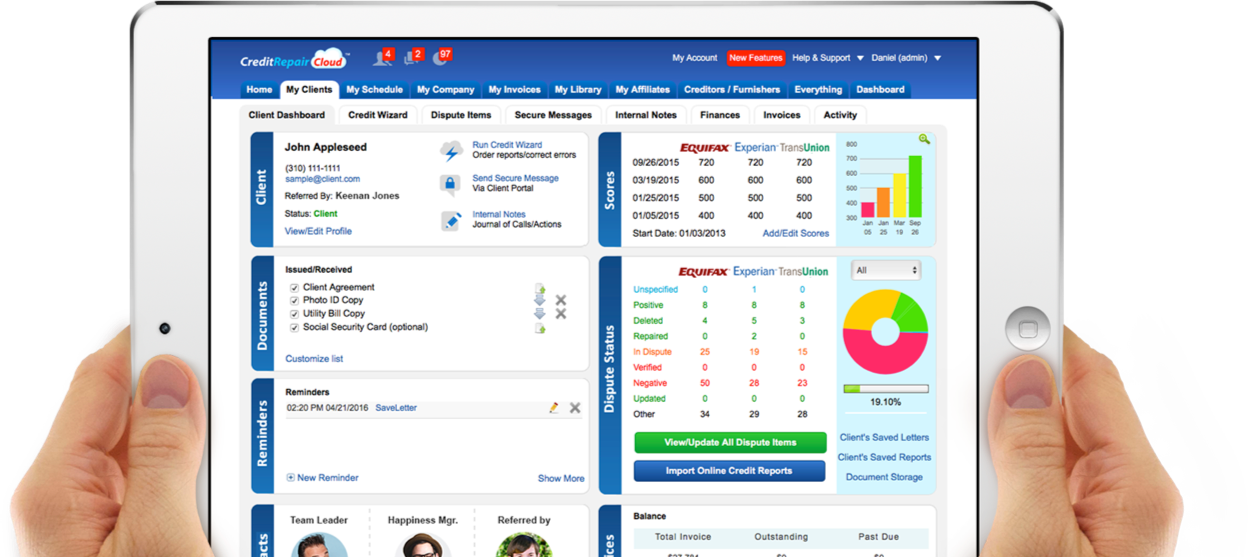

You can start on a trading platform regulated in your country, with VASP approval (Virtual Asset Service Provider), with only ten dollars. In general, 4 steps are enough:

- create a customer account, fill in their personal information, and have their identity validated by photographing an official document;

- deposit funds on the exchange platform. Several means of payment are offered (credit card, bank transfer, PayPal, etc.);

- search for “Bitcoin” or “BTC” in the search tool for available cryptos and click on “buy / trade / invest”;

- enter the quantity of bitcoins corresponding to the amount you wish to invest, and confirm the transaction;

To store bitcoins outside of a centralized platform, investors can use personal e-wallets.

If Bitcoin can be used for the purchase of goods and services from certain companies, payment by cryptocurrency is not very democratized , which complicates its use in everyday life. As a result, it is rather considered as a financial asset for invest in the medium or long term (particularly in DCA). It is essentially an investment, a store of value. Investing in Bitcoin means betting that this technology will be sustainable. And like any financial asset, it is of course possible to trade it to generate short-term profits by betting on its price variations.

Our Recommendations before Investing

It is certain that investing in Bitcoin can seem complicated, compared to other financial products such as stocks. However, those who took the gamble of buying the “safest” cryptos on the market several years ago made significant capital gains.

Before you decide, here are some recommendations to keep in mind:

- it is important to learn about the operation of blockchain technology, which is the fundamental system on which the value of cryptocurrencies is based;

- get information on official websites and do not hesitate to get in touch with other investors via crypto communities;

- limit your investments to what you are able to lose, and bear: Bitcoin’s price volatility is high, which can generate a lot of stress and frustration.

The Safety of Your Funds is a Priority

Privacy and security are important topics for bitcoin investors. Anyone who obtains the private key of a public address on the Bitcoin blockchain can authorize transactions. Your private keys should be kept secret, as criminals may try to steal them, especially if they learn you have large sums of money. Anyone can see the balance of a public address you use on the blockchain. This is also one of the fundamental advantages that allowed bitcoin to emerge as a revolutionary technology.

An individual can create multiple public addresses for their own account. Thus, he can distribute his reserve of bitcoins over many “accounts”.