In an era of ever-evolving financial complexities, it is imperative for individuals to possess a strong foundation in personal finance. Unfortunately, traditional education systems often fail to adequately equip students with the necessary skills to navigate the intricate world of money management. Recognizing this gap, Next Gen Personal Finance (NGPF) has emerged as a pioneering platform dedicated to empowering financial literacy among young adults. NGPF offers a comprehensive suite of resources, curricula, and interactive tools designed to engage and educate students on personal finance topics. In this article, we delve into the remarkable features of NGPF, its impact on financial education, and its potential to transform the lives of individuals by fostering crucial financial skills.

ngpf

The NGPF Story: A Revolution in Financial Education

Next Gen Personal Finance was founded in 2014 by Tim Ranzetta, a passionate advocate for improving financial literacy in schools. Ranzetta recognized the dire need for a modern and engaging approach to financial education, one that would resonate with students and empower them to make informed financial decisions. Thus, NGPF was born.

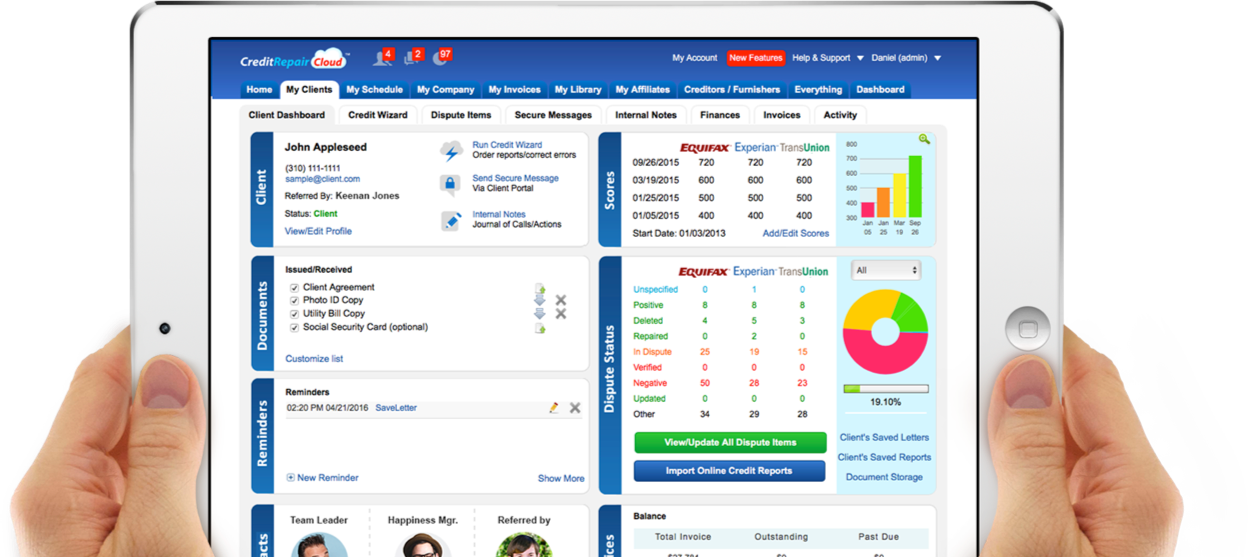

The NGPF curriculum boasts an extensive range of lesson plans, activities, projects, and assessments that cover key personal finance topics. These topics include budgeting, saving, investing, banking, insurance, credit, and more. The curriculum is aligned with national standards and is designed to be easily adaptable to various teaching environments, including traditional classrooms and remote learning settings.

Interactive and Engaging Learning Experiences

NGPF stands out by employing innovative teaching methods and interactive learning experiences that captivate students’ attention and enhance their financial literacy. The platform offers a rich collection of online games, simulations, case studies, and videos, allowing students to apply theoretical knowledge to real-life scenarios.

One notable NGPF feature is the “Banking on Our Future” simulation. This immersive experience enables students to manage virtual bank accounts, make financial decisions, and understand the consequences of their choices. By simulating real-world financial transactions, students gain practical insights into budgeting, saving, and investing.

Moreover, NGPF’s student-centered approach encourages critical thinking and problem-solving skills. Through project-based learning activities, such as the “Payback” project, students explore the implications of student loans and make informed decisions about college affordability. These hands-on experiences instill financial responsibility and promote informed decision-making.

Supporting Educators: NGPF’s Teacher Resources

Recognizing the importance of well-equipped educators, NGPF provides comprehensive support to teachers through a wealth of resources. NGPF offers professional development workshops, webinars, and an active community forum, enabling educators to enhance their teaching techniques and exchange ideas with peers. These resources ensure that teachers feel confident and competent in delivering high-quality financial education.

Additionally, NGPF’s assessment tools enable educators to measure student progress and tailor instruction accordingly. Pre- and post-assessments, quizzes, and surveys help track students’ understanding of personal finance concepts. NGPF’s Learning Management System (LMS) also allows teachers to monitor student engagement and provide personalized feedback.

The Impact of NGPF: Empowering Financially Savvy Individuals

Next Gen Personal Finance (NGPF) has made significant strides in improving financial literacy among young adults. Educators who incorporate NGPF into their classrooms report increased student engagement, improved knowledge retention, and enhanced financial decision-making skills.

By equipping students with essential personal finance skills, NGPF has the potential to positively impact their lives beyond the classroom. Financially literate individuals are better prepared for future financial challenges, more likely to make informed decisions, and less vulnerable to predatory financial practices.

You have to wait 30 seconds.